Last law to change rates was the American Taxpayer Relief Act of 2012. Last law to change rates was the Tax Cuts and Jobs Act of 2017. These adjust annually in line with inflation, under the tax code, to provide for mandatory cost of living adjustments (COLA). Rates and Brackets In Nominal Dollars, Income Years 1862-2021 This article provides a summary of changes and updates to IRS Federal tax rates and brackets. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. imposes a progressive income tax where rates increase with income.

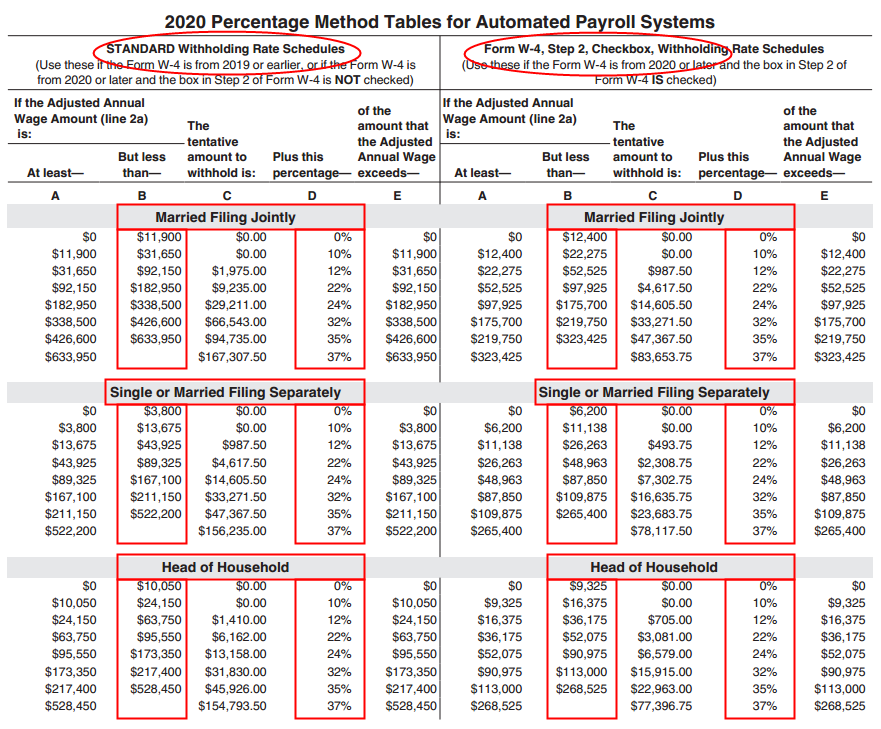

Number shown in illustrations are based on IRS published data stating that average 2022 tax refunds were more than 3039. Tax reform set the individual income tax rates at 10, 12, 22, 24, 32, 35 and 37. The highest tax bracket that applies to your income determines your marginal tax rate. For tax year 2020, the adjusted gross income amount used by joint filers to determine the reduction in the Lifetime Learning Credit is 118,000, up from 116,000 for tax year 2019. Actual refund amounts vary based on your tax situation. Because our federal tax system is progressive, it’s possible for your income to fall into more than one bracket. For family coverage, the out-of-pocket expense limit is 8,650 for tax year 2020, an increase of 100 from tax year 2019.

#2019 federal tax brackets software#

Federal Individual Income Tax An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. Over 90 Million Returns Filed: Based on e-filed federal returns through TaxAct Consumer and TaxAct Professional software since 2000.

Federal Corporate Income Tax Rates & Brackets Historical U.S.

0 kommentar(er)

0 kommentar(er)