Just like closing old accounts, you want to be careful about opening new ones. New credit and credit mixĬoming in at 10 percent with FICO and “less influential” for VantageScore are new credit accounts. This measures the length of your oldest credit line and the average age of your accounts, so try to keep your oldest accounts open if possible. At 15 percent for FICO and considered “less influential” with VantageScore is credit history, which is not to be confused with your payment history. The remaining three pieces are not weighted as heavily, but they are still important. And if you’re approved, don’t let your higher credit line encourage you to spend more than you can pay back. But keep in mind that a credit limit increase request could result in a hard pull on your credit report. Tip: One way to lower your credit utilization is to ask your card issuers for higher credit limits. For most of us, something in the range of 20 percent to 25 percent will keep your score in good shape. People with the best scores are in the single-digit percentage points in this category. As soon as you pay your statement, your credit utilization drops. Here’s how it works: If you have a $5,000 credit limit and charge $1,000, your credit utilization is 20 percent. This accounts for up to 30 percent of your FICO score and is extremely influential on your VantageScore. Next is your credit utilization, or how much of your available credit you are using.

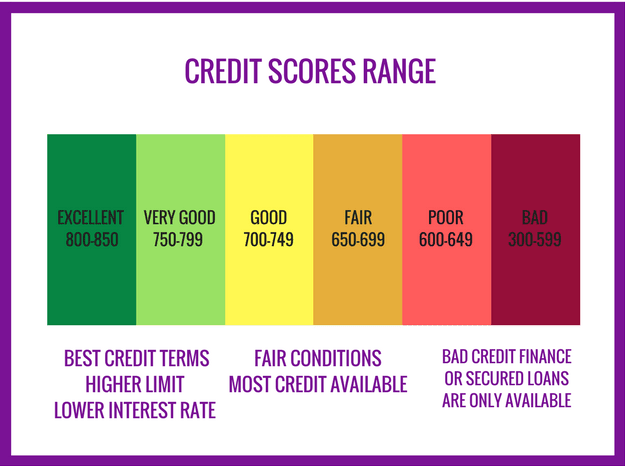

If a bill comes due and you find that you can’t pay it, it’s always best to call the company and work out a mutually beneficial payment plan to avoid outright missing a payment. To earn the best score, your goal should be to never miss a payment date on any of your accounts, whether that be a loan, mortgage or credit card. Payment history makes up 35 percent of your total FICO score and is considered “moderately influential” on your VantageScore. These are the factors that make up your credit score: Payment history Less influential: credit age and new accounts.Moderately influential: payment history.Highly influential: credit mix and experience.Extremely influential: credit usage, balance and available credit.Meanwhile, VantageScore ranks factors’ importance in this order: FICO lays out the percentages of 100 percent of the different factors considered when calculating a credit score and VantageScore uses “reason codes” to create a hierarchy of importance for the factors.įICO calculates credit scores by weighing these factors: However, FICO and VantageScore weigh the credit profiles of consumers quite differently. As shown above, what FICO and VantageScore both consider “fair” or “good” credit differ slightly, with FICO using a score of 670–739 to describe good credit and VantageScore using 661–780 for the same category. VantageScoreįICO and VantageScore are very similar consumer credit-scoring models, both using a scale of 300 to 850 when calculating credit risk. The greater the risk, the lower your score and the more you’ll pay to access credit - if you can access any at all. While credit scores help determine your availability of credit and the rate you’ll pay to access it, what it really measures is your statistically proven likelihood of defaulting on the money you borrow. Here’s how they break it down: Credit Score Ranges The two biggest creators of credit scores are FICO and VantageScore. However, you can get a good general idea of your credit from your credit score. A score of 580 to 669 is considered a fair score, but you’ll get better rates with a higher score.Ĭredit card issuers define “good credit” differently, so you sometimes can’t know until you apply whether you’ll be approved for a credit product or get the best rate. And while over 800 is an exceptional score, it won’t get you much more.Īny score below 579 is not where you want to be. Scores in the range of 670 to 739 are good, and they may be good enough for most people. What is a good credit score for a credit card? Here’s what you need to know about good credit scores and how they’re calculated. But if your credit score is higher than average, you could reap the benefits of lower interest rates and higher lines of credit on cards. What’s a good credit score? According to FICO, the average credit score is 716. Credit scores also determine the interest rate you’re charged for using lines of credit on cards and loans. Credit scores are undoubtedly important - they determine our eligibility for a variety of financial products, including credit cards.

0 kommentar(er)

0 kommentar(er)